Residential Roof Insurance Claims: How To

Dealing with a residential roof insurance claim can be a complex process. However, by following certain steps and understanding the insurance claim process, you can navigate through it more effectively. This comprehensive guide will outline the necessary steps to take when filing a residential roof insurance claim.

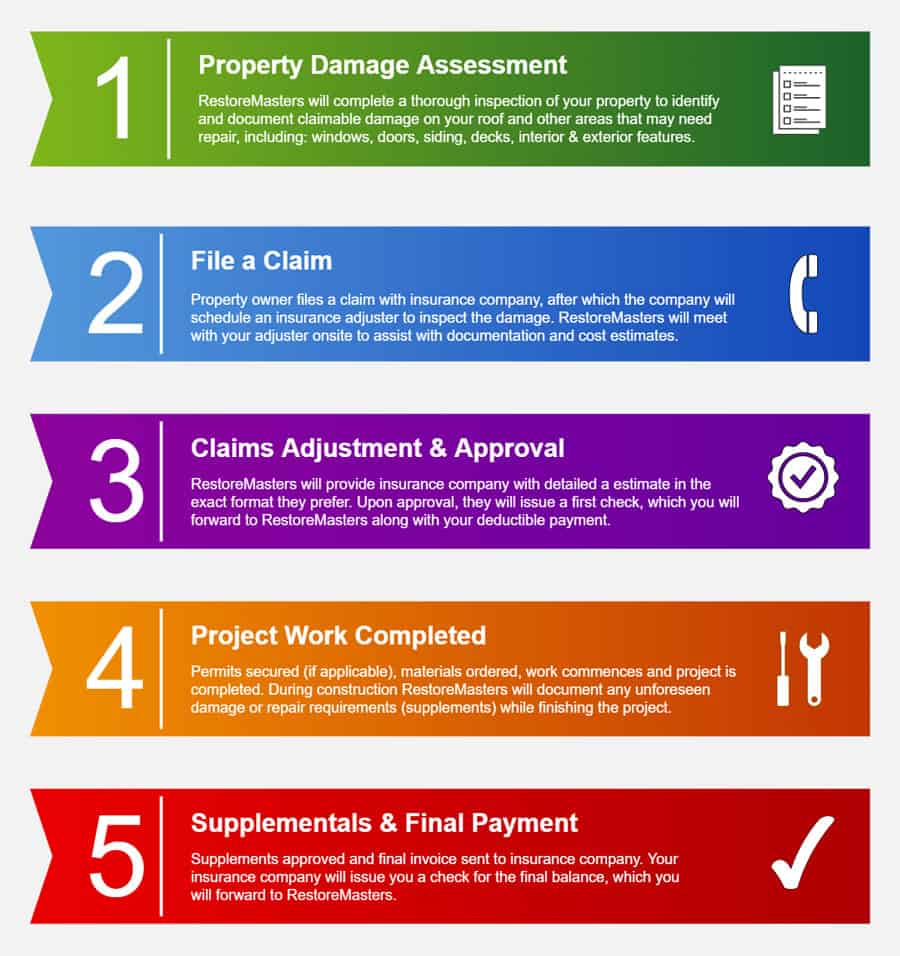

1. Assess the Damage The first step in filing a residential roof insurance claim is to assess the damage to your roof. Inspect your roof thoroughly for any signs of damage such as missing or damaged shingles, leaks, or structural issues. It is essential to document the damage by taking photographs or videos as evidence for your insurance claim.

2. Review Your Insurance Policy Before proceeding with the claim, review your insurance policy to understand what is covered and what is not. Pay attention to specific details such as deductibles, coverage limits, and exclusions related to roof damage. Familiarize yourself with the terms and conditions of your policy to ensure you meet all requirements when filing a claim.

3. Contact Your Insurance Company Once you have assessed the damage and reviewed your policy, contact your insurance company to initiate the claims process. Provide them with all relevant information regarding the damage, including photographs and videos. Be prepared to answer questions about the cause of the damage and any pre-existing issues with your roof.

4. Schedule an Inspection Your insurance company will likely send an adjuster to inspect the damage and assess the cost of repairs or replacement. It is crucial to be present during this inspection to ensure all damages are properly documented. If possible, have a roofing contractor present as well to provide their professional assessment.

5. Obtain EstimatesAfter the inspection, obtain estimates from reputable roofing contractors for repairing or replacing your roof. These estimates will help determine the scope of work required and provide an accurate estimate of the costs involved. Ensure that the estimates are detailed and include all necessary repairs and materials.

6. Document the Claims Process Throughout the claims process, keep detailed records of all communication with your insurance company, including dates, times, and the names of the representatives you speak with. This documentation will be valuable if any issues or disputes arise during the process.

7. Submit Your Claim Once you have gathered all necessary documentation, including estimates and photographs, submit your claim to your insurance company. Follow their specific instructions for claim submission, which may involve filling out claim forms or providing additional information.

8. Cooperate with the Claims Adjuster After submitting your claim, cooperate fully with the claims adjuster assigned to your case. They may require additional documentation or information to process your claim effectively. Respond promptly to any requests and provide any necessary supporting evidence.

9. Review the Settlement Offer Once your claim has been processed, your insurance company will provide a settlement offer outlining the amount they are willing to pay for the roof repairs or replacement. Review this offer carefully and compare it to your estimates and policy coverage. If you believe the offer is insufficient, you can negotiate with your insurance company by providing additional evidence or seeking professional assistance.

10. Complete Repairs If you accept the settlement offer, proceed with completing the necessary repairs or roof replacement using reputable contractors. Keep records of all expenses related to the repairs, including invoices and receipts.

11. Finalize Your Claim After completing the repairs, notify your insurance company that the work has been finished. They may request proof of completion, such as photographs or a contractor’s certificate of completion. Once satisfied, they will finalize your claim and issue any remaining payment owed.

It is important to note that every insurance policy and claim process may vary slightly, so it is essential to consult your specific policy and communicate directly with your insurance company for accurate guidance throughout the claims process.